Looking to sell your Kanawha County property? Before you do, you need to check if there are any liens or judgments against it. If you find that there is, this can be a pretty nasty roadblock. Don’t worry, it’s not the end of the selling journey for you.

Here’s everything you need to know on how to sell a house with judgments in Kanawha County.

What is a Judgment and How Does it Affect my Kanawha County Property?

Before discussing judgments, you first need to know what a lien is.

A lien is a legal claim or right against someone’s property, typically used as security for the payment of a debt or other obligation such as child support.

When you decide to sell your Kanawha County property, you may have to deal with liens that are placed on the property by creditors. These liens can make it difficult to sell the home or refinance the mortgage, so it’s important to be aware of them before making any decisions.

A judgment, on the other hand, is the court decision done in connection with the lien. A lien in itself is not enough of a claim against the property, but a judgment made in connection with the lien is.

Can I Sell a Property with Judgments in Kanawha County?

Yes, you can sell a property with judgments on it, but the process may be more complicated than selling a home without any judgments. When you have judgments against your property, the creditors who placed the judgments will need to be paid off before the sale can be completed. This can make it difficult to find a buyer who is willing to pay the full amount that you owe, so you may need to work with a real estate agent who has experience dealing with properties with liens. Additionally, you may need to sell your home for less than the market value in order to attract buyers.

Sell to a Professional Cash Home buyer in Kanawha County

Going the traditional route of listing your property on the market (either with or without an agent) can take a while and unless you have enough equity to pay back all debts with the proceeds of the sale, resolving judgments will also add to the time it takes to close and the buyer can walk away.

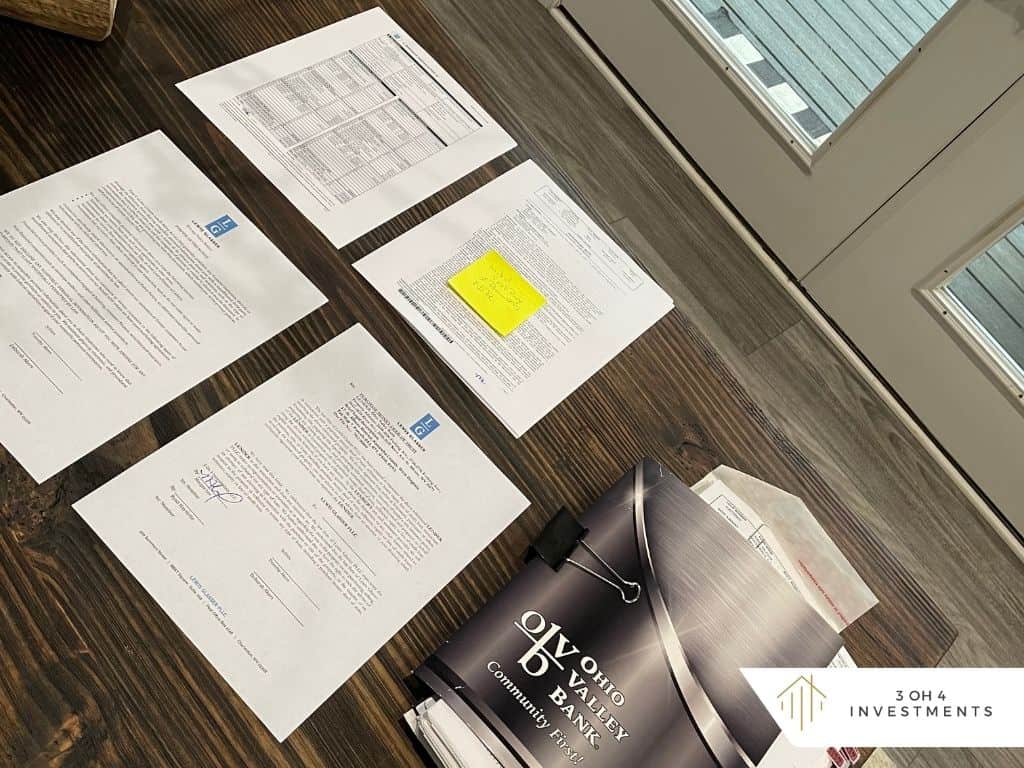

If you’re looking for a way to sell your house fast in Kanawha County, an easy solution to this is get a cash homebuyer through a real estate investment company like 3 Oh 4 Investments, LLC. A cash homebuyer in Kanawha County offers many advantages.

Companies like 3 Oh 4 Investments have cash available and are less likely to walk away from the deal even if it takes time to resolve the judgment. In fact, you don’t need to even resolve it at all! At 3 Oh 4 Investments, we buy houses in Kanawha County in all sorts of conditions, even one with judgments. The process to getting a fair cash offer are also easy and quick – usually only taking 3 days. The best part is you get to choose your closing date so you can be sure when you’ll be able to pay the taxes back and stop the debt from growing.

Contact 3 Oh 4 Investments, LLC today!

Interested in selling to cash homebuyer? Then sell to us at 3 Oh 4 Investments!

Our process does not involve getting pre-qualified by a mortgage bank in order to obtain a property loan or listing the property on the MLS or any other listing platform. The reason our team at 3 Oh 4 Investments, LLC is able to purchase properties very quickly is because we use our own money, which means the sale is more secure and we can close faster than a traditional buyer.

Once we provide you a FAIR CASH OFFER for your property, the decision to accept or decline our offer is completely up to you. The best part of our process is that it’s absolutely FREE. You are in no way obligated to take our cash offer if it does not align with your expectations.

To find out more about our property buying program, please call us today: (304) 314-4341.